The Problem with Traditional B2B Lifecycle Models (And What to Do Instead)

Your field marketing team collects a warm list from an event and marks them as MQLs. Sales follows up, exchanges a few emails, and creates an opportunity. Then the buyer goes quiet and the deal is marked Closed-Lost.

Months later, the same company shows interest again at another event. They are engaged and showing intent. But in your system, they are still stuck as Closed-Lost and cannot re-enter the funnel.

This is a common problem. Traditional lifecycle models assume buying moves in one direction.

Real buyers move back, pause, and restart. When your model cannot track this, your funnel data becomes wrong and teams lose visibility.

Why Traditional B2B Lifecycle Models Are Failing

The linear lead lifecycle model was created when B2B buying was simpler. Fewer stakeholders were involved, buying cycles were shorter, and sales reps controlled more of the information flow. There are several reasons the traditional lifecycle model no longer suits the current buying landscape:

1. Non-linear buying journey

Everyone is familiar with the classic B2B lifecycle model:

Known → Engaged → MQL → SAL → SQL → Opportunity → Closed-Won

On paper, it looks clean. It provides:

- clear handoff points

- structured reporting

- an easy way to measure funnel performance

But real buyers don’t behave this way.

Today’s B2B buying process is anything but linear. In fact, about 86% of B2B purchases stall during the buying process. There are several reasons for this. For instance, a potential customer might download a whitepaper, have initial sales conversations, and then disappear for months. Or a key decision maker might leave.

Yet, most companies still try to fit buyers into a rigid, one-directional funnel, and that creates major issues.

2. MQL and SQL Confusion

Most B2B lifecycle models classify leads as MQLs and SQLs. This is a structured approach to lead progression. But it also introduces misjudgments in lead readiness. Many leads are marked as “qualified” just because they downloaded a whitepaper or attended a webinar, even if they’re not ready to buy. So, the future of B2B lifecycle models is beyond MQLs and SQLs.

Meanwhile, high-value prospects might get ignored simply because they don’t meet arbitrary scoring criteria. If a lead is marked as Closed-Lost, most systems don’t track when they re-enter the buying process. Consequently, sales teams miss key re-engagement opportunities.

3. Ignoring Multiple Entry and Exit Points

Traditional B2B lifecycle models assume that every lead follows the same path. After all, it:

- starts as an inbound lead

- moves through marketing nurture

- is handed off to sales

But real buyer journeys don’t work like that. Some leads start by downloading content. Others may start by engaging with ads or attending webinars. And some are brought in through outbound sales.

A traditional linear model only tracks a single starting point. If a lead enters through outbound sales rather than marketing, it won’t be properly tracked within marketing funnel reports. Similarly, if a deal is lost but later re-engages, there’s no structured way to track its reactivation.

4. Poor cross-departmental collaboration

The traditional lifecycle model treats marketing, sales, and customer success as separate entities. Each is responsible for a specific stage of the funnel. This rigid structure creates misalignment between teams and silos where each team only tracks their part of the process.

In reality, customers don’t engage in neat, department-specific stages. Instead, their journey is continuous and interconnected. Without sales and marketing alignment, companies lose visibility into key touchpoints that influence revenue, such as post-sale engagement, re-engagement opportunities, or expansion potential.

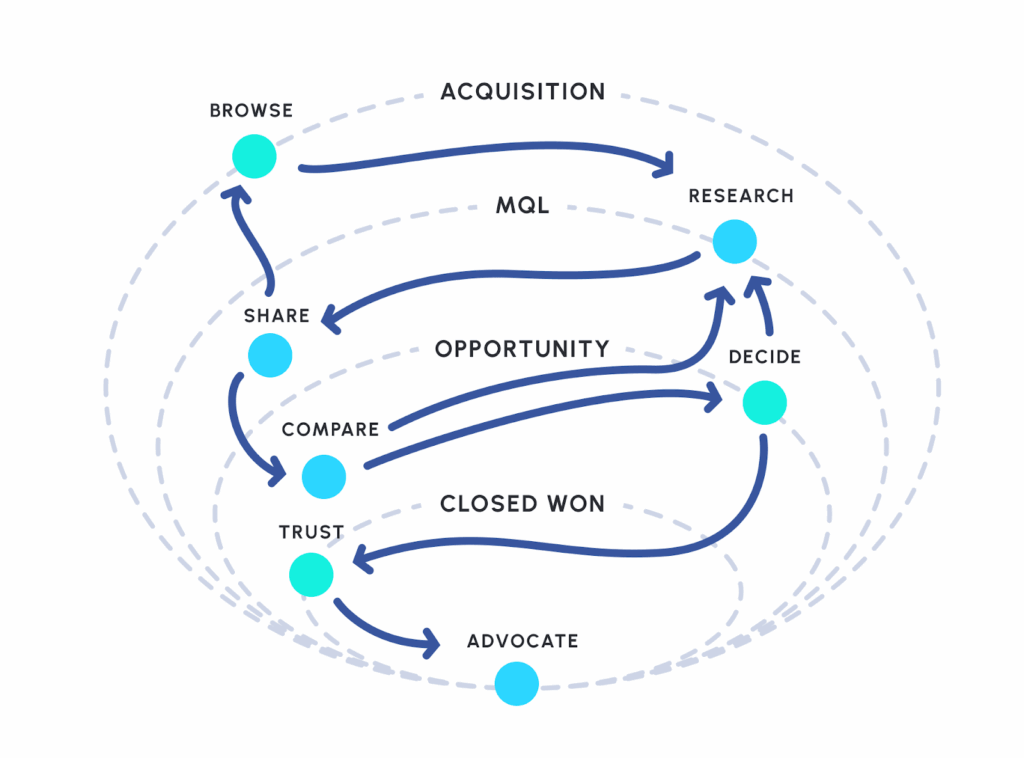

What today’s RevOps teams need is an advanced, multi-path RevOps lifecycle model that is flexible, intent-driven, and reflects the real complexity of B2B buyer journeys. Unlike traditional linear models that force leads into predefined sequences, a mature model adapts dynamically based on engagement, behavior, and intent signals across marketing, sales, and customer success.

Here’s how it looks in real life:

How Modern B2B Buying Journeys Actually Work Today

Modern B2B buying no longer moves in a straight line. Rather, modern journeys are built on behavior.

Buyers Start Long Before Sales

A buyer might first hear about a product from a LinkedIn post, then disappear for three months, then come back through a webinar invite, and only much later talk to sales after their team has already tested the product on their own.

Most buyers now do their research quietly. For instance, they’d read blog posts, compare tools on review sites, watch demo videos, and ask peers for advice long before they ever fill out a form or reply to an email.

The Product Is the First Sales Call

Sales is no longer the starting point. In many cases, the product itself becomes the first real sales conversation. Why? Because free trials, freemium plans, and self-serve demos let buyers experience value before they ever speak to a human.

People do not move forward just because marketing nudges them. Rather, they move when their internal timing is right, when a problem becomes painful, or when a new project suddenly makes a solution feel urgent.

Buyers Move Back and Forth

This means buyers jump between stages. Someone can look like a cold lead today, an active user tomorrow, and a serious buyer next week. All based on what they are doing inside the product and what problems they are trying to solve.

Multiple people are also involved. A champion might start using the tool. A manager might review pricing. A finance team might pause the deal. This creates long gaps that traditional funnels cannot explain.

Behavior Tells the Real Story

Buying is complex. It involves pauses, resets, internal debates, and side research that never shows up in simple lead scores or pipeline stages.

That is why product signals matter so much. Usage, feature adoption, trial behavior, and account activity now tell a clearer story about buying intent than email opens or whitepaper downloads ever did.

What Should You Consider When Implementing a Lifecycle Model?

Here are some tips for building a mature lifecycle model:

Recognize Multiple Lifecycle Journeys

Implement a lifecycle framework that accommodates multiple conversion routes. It should recognize that prospects don’t always follow a straight line and can become sales-ready more than just once.

Embrace Outbound Outreach as Part of the Funnel

Implement specific stages to handle all records that are brought in from third-party data sources like Apollo.io, Zoominfo, and SDR teams work on warming them for your Sales team.

Track Engagement Across the Entire Revenue Team

Create a unified tracking system where all touchpoints, such as marketing nurture, sales interactions, and customer success engagements, and all channels, such as paid, social, organic, syndication, and outbound, contribute to a holistic view of the buyer’s lifecycle journey.

Allow Non-Linear Movement

Keeping prospects in a one-way linear path creates a rigid system for your marketing and sales team. So, design a model where your lifecycle stage tracking fields, scoring model, engagement programs, paid marketing audiences, and ABM programs adjust dynamically based on buyer behavior.

Consider Opportunity at an MQL Stage Model

Creating the Opportunity at the MQL stage aligns the BDR/Sales team to have one single object and a unified view of the entire sales funnel.

Another primary benefit of the creation of an Opportunity at the MQL Stage is that this allows you to report on multiple journeys throughout the funnel, as not all records will progress linearly.

Similarly, the compositional attributes of the company may change in repeat journeys. Being able to capture and store that data will help you understand how different types of accounts progress through the funnel as well as what influences their progression.

You need an advanced lifecycle model if you face challenges in tracking, managing, and optimizing the movement of prospects through your funnel. The below questionnaire will help you determine if you’re good with a linear lifecycle model or if you need a non-linear B2B lifecycle model.

| Question | Yes | No |

| Are you crediting a single source for lead generation? | Your attribution model may be oversimplified. Consider multi-touch attribution to better understand the full buyer journey. | You should ensure that for each stage proper source and channel is tracked. This helps identify which source / channel works better for which lifecycle stage. |

| In your CRM, are there deals that had multiple marketing and sales interactions? | This indicates that a linear model may not capture the true journey. Implement tracking for multi-touch engagement. | You may need to investigate if tracking is missing multi-touch interactions or if engagement is truly limited to one source. |

| Do your prospects interact with multiple departments (Marketing, Sales, CS) before making a decision? | A cross-functional lifecycle model can help track and align interactions across teams. | Either your sales process is highly direct, or your tracking is incomplete. Review how buyers interact before purchase. |

| In your current model, do your prospects move backward in lifecycle stages? | This is a sign that a rigid lifecycle model isn’t capturing real buyer movement. Consider allowing non-linear transitions. | If this is accurate, your lifecycle model is working well, but ensure you are not losing potential re-engagements. Ensure that the tracking data for each stage is updated accordingly. |

| Do your prospects skip lifecycle stages (e.g., MQL to Closed-Won)? | Skipping stages suggests a need for a more flexible lifecycle model based on intent rather than predefined steps. | Your current model is structured well, but make sure it’s allowing flexibility when needed. |

| Do you have leads marked as Closed-Lost that later re-engage and convert? | You should track re-engagement separately and nurture these leads differently rather than treating them as new. | Check if your team is missing opportunities for re-engagement and if ‘Closed-Lost’ is truly final. |

| Are there significant delays between marketing handoff and sales action? | This suggests misalignment between teams. Introduce real-time engagement tracking to improve handoffs. | Your handoff process is well-optimized, but continuous monitoring can ensure efficiency. |

| Do your lifecycle stage conversion rates show a healthy and explainable pattern across each stage? | Good! This suggests a well-aligned lifecycle, but check if stagnation occurs over time. | Inconsistent conversion rates may indicate that your lifecycle model isn’t properly identifying sales-ready leads. |

| Do you track how often leads re-engage after being marked inactive? | Leverage this data to create a dedicated re-engagement strategy rather than starting fresh. | You may be missing valuable opportunities. Consider tracking returning leads and analyzing their intent. |

| Are customer expansion and upsell opportunities part of your lifecycle tracking? | Great! Post-sale engagement should be an integral part of the lifecycle model. | You might be overlooking revenue opportunities. Include customer success touchpoints in your lifecycle tracking. |

How Can RevOps Global Help?

A linear lifecycle model isn’t wrong. In fact, it’s a great starting point for companies that want to establish structure and alignment. The problem arises when businesses stop there.

But the problem starts when teams treat it as the final answer. Once buyers begin to loop back, use the product, or re-engage after going quiet, a straight-line funnel can no longer show what is really happening.

At RevOps Global, B2B lifecycle models are built directly inside Salesforce to handle real GTM behavior, not idealized flows. These models support multiple entry points. They keep history when records move between stages. They stay stable as the business scales. So, you get far more reliable, clear reporting and forecasting.

One key difference is cohort-based lifecycle tracking. Instead of looking at all leads or accounts as one group, teams can track how specific segments move through the funnel over time. This reveals what actually converts. Revenue teams can see which sources, segments, or product motions create the best outcomes and which ones stall.

The result is clearer GTM visibility. And forecasts that are based on real buying behavior, not broken stages or missing data. Book a demo today to see how a dynamic, multi-path revenue operations lifecycle model can transform your pipeline.

FAQs

Why do traditional B2B lifecycle models fail?

Traditional models follow a straight line: lead to MQL to SQL to deal. But real buyers do not move that way. They stop, come back, and use the product. They talk to sales again. Old models ignore product data and buyer intent. So, teams lose track of what really drives revenue.

Can a Closed-Lost deal re-enter the sales funnel?

Yes. Very often. Many deals are marked Closed-Lost because of timing, budget, or priorities. But that buyer may return later. They may try a free trial. Or they may engage with content. An advanced model lets them re-enter without being treated like a brand-new lead.

What is an advanced lifecycle model in RevOps?

Advanced lifecycle modeling tracks both people and product signals. It does not stop at MQL or Closed-Won. It includes trials, active users, churn risk, and re-engagement. It shows where revenue really comes from. RevOps teams use it to connect marketing, sales, and product into one clear flow.

How does an advanced lifecycle model improve forecasting?

It uses real behavior. Not just form fills. It looks at product usage, sales activity, and buying intent. This gives better signals about who will buy or renew. This way, forecasts are based on how customers actually move through the funnel.